NCC Offers Tax Prep to Students Through Single Stop

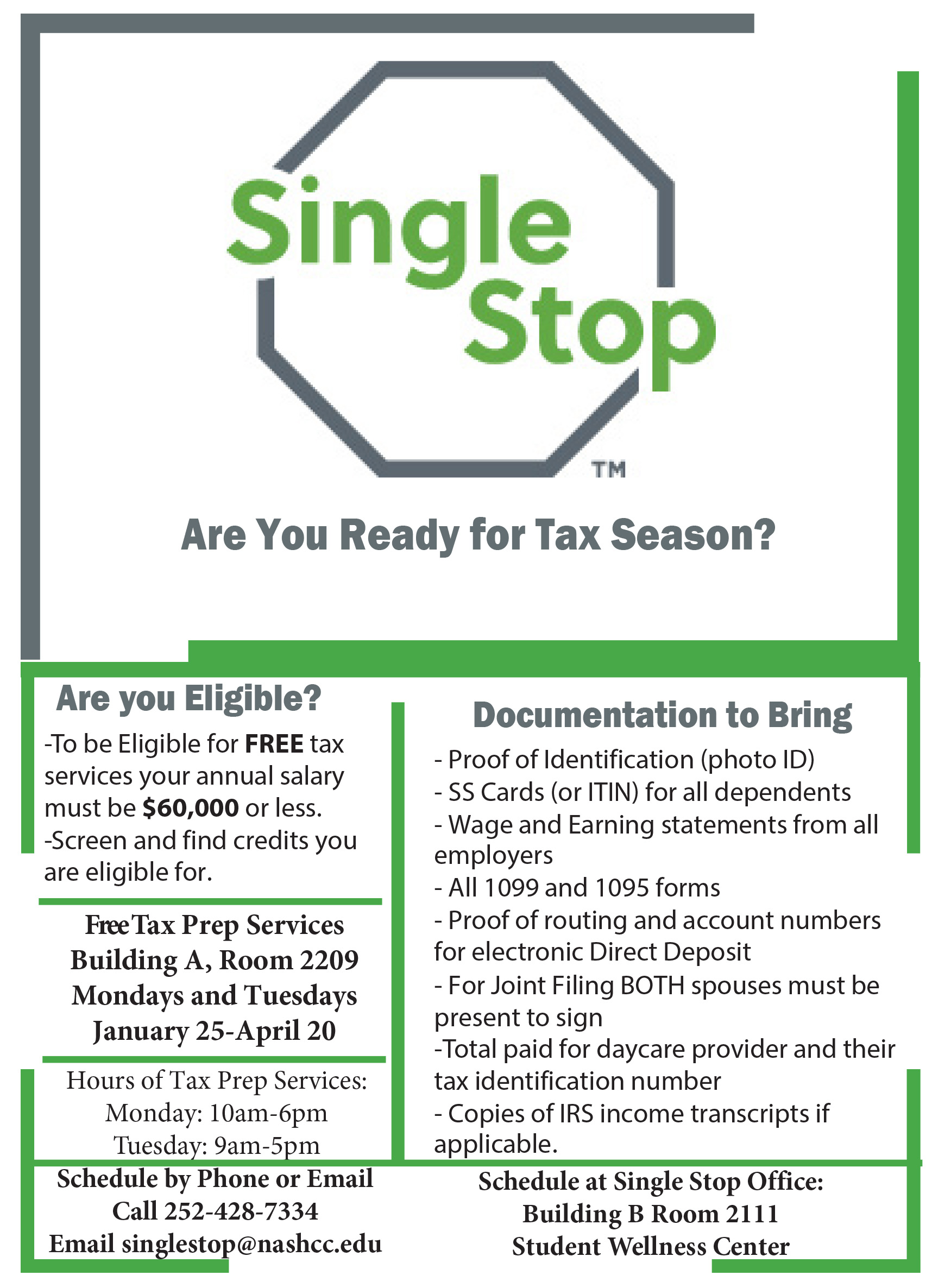

As one of the Single Stop services provided through the Student Wellness Center at Nash Community College, free tax preparation is being provided on campus to students. In Fall 2015, Nash Community College received a grant funded through the Belk Endowment to partner with Single Stop, a nationally recognized poverty alleviation non-profit organization. Comprehensive services provided to students through Single Stop include screenings for national, state, and local benefits, benefits counseling, on-campus SNAP application and recertification assistance, free tax preparation, and referrals to helping agencies within the community including childcare, housing, and food assistance. Providing on campus tax preparation enables Nash Community College students to receive the maximum Earned Income Tax Credits, fast IRS verification and electronic access to refunds, as well as assistance in completion of the Federal Aid For Students Assistance (FAFSA) application to secure student financial aid for Fall 2016 to qualifying students.

As one of the Single Stop services provided through the Student Wellness Center at Nash Community College, free tax preparation is being provided on campus to students. In Fall 2015, Nash Community College received a grant funded through the Belk Endowment to partner with Single Stop, a nationally recognized poverty alleviation non-profit organization. Comprehensive services provided to students through Single Stop include screenings for national, state, and local benefits, benefits counseling, on-campus SNAP application and recertification assistance, free tax preparation, and referrals to helping agencies within the community including childcare, housing, and food assistance. Providing on campus tax preparation enables Nash Community College students to receive the maximum Earned Income Tax Credits, fast IRS verification and electronic access to refunds, as well as assistance in completion of the Federal Aid For Students Assistance (FAFSA) application to secure student financial aid for Fall 2016 to qualifying students.

On campus tax preparers hold IRS Advanced Certification and provide free, confidential services. All participants must provide required IRS documentation including a valid photo id, SS numbers (or ITIN) and all proof of earnings including W2s, 1099, 1098 forms as well as verification of qualifying deductions. Students may learn more or schedule an appointment for free tax preparation services by contacting the Single Stop office at 252.428.7334 or scheduling by email at singlestop@nashcc.edu. Nash Community College is a registered IRS Tax Preparation site. This service is offered to qualifying students and community members earning less than $60,000. Offered January 25-April 20, 2016.